This course is intended for all employees who work in the domain of Private Banking & Wealth Management. It is not jurisdiction specific and can be used globally. It is:

- Suitable for all users;

- Available in English and French versions;

Objectives:

There are 4 main objectives of this course:

1. You gain an understanding of the AML risks posed by Private Banking & Wealth Management products and services;

2. You can identify potential AML red flags on client transactions;

3. You have an awareness of AML examples and typographies relevant to Private Banking & Wealth Management;

4. You understand the obligations on regulators to perform monitoring and supervision activities;

Modules:

The course has 4 main modules covering what we call the 4Rs of AML:

1. Risks – which are inherent in your line of business;

2. Red Flags – which your members of staff should be particularly aware of;

3. Real Examples – of money laundering or terrorist financing using products and services similar to yours;

4. Regulatory Inspections – what regulators

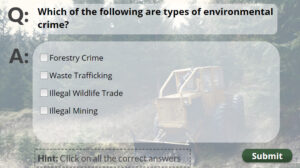

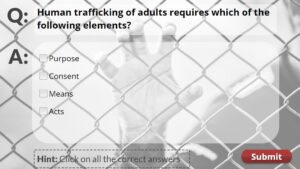

Knowledge Check:

There is a 10 question knowledge check at the end of the course with a standard pass mark of 80% and unlimited attempts. The 10 questions are drawn randomly from a larger bank of questions. Each attempt will draw a different mix of questions.

Course Length:

45 minutes + 10 minutes of questions.

Certificate:

The user will receive a certificate in pdf format upon successful completion of the course and knowledge check.

Licence Information:

Each purchase is for a licence for a single user. The user has access to all the course material for 6 (six) months via our web based elearning platform.

Reporting:

For volume purchasers, your nominated administrator will be able to download:

- A set of detailed reports in Excel format showing course completion data for all of your users; and

- Copies of all certificates.

Compliance Officer Reviews:

Our courses have been reviewed and approved by over 100 Compliance Officers and deemed appropriate for use by all of their employees. We regularly update the course material as regulations evolve. Additionally, whilst the CSSF and CAA do not approve any local training materials, our Belgian version (which shares much of the content) has been formally approved by the FSMA.

Our Feedback (from our range of courses):

“It was a great experience to participate in a professional e-learning course.”

“Good presentation, interactive implementation makes education process more interesting.”

“Very clear and well structured. The examples are excellent!”

Course Customisation (optional):

We can customise this course for your organisation. Customisation can include:

- Branded website and course

- Branded certificates

- Additional material covering your organisation and its AML policy and procedures